Attention - you cannot pay your mortgage with a credit card.

Attention - you cannot pay your mortgage with a credit card.Obama is on the prompter like a preacher looking to build a new church - "The good news is that we have the money to build the church! The bad news is that it's out there in your pocket."

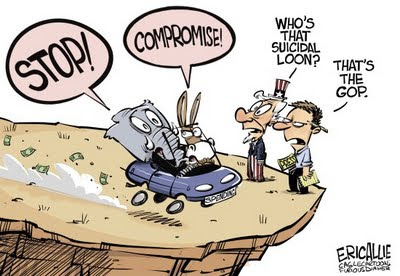

There's been plenty of yelling and screaming - and a lot of anger toward the Tea Party. This doesn't make sense to me - since they're the ones who hit the fire alarm. Oh, it's because they're birther racists? No, the party is called "tea" because it means Taxed Enough Already. When they called their freshman Congressman that they got elected to the House - they reminded them why the Boehner Bill sucked. They may have mentioned that compromising with the President was a bad idea -- especially since it involved more taxes. More taxes doesn't address the problem - and it's like giving an alcoholic more booze to get them to stop drinking so much. That's the problem. It is Norm Peterson, on a bender, with a tab he has no intention of ever settling. One more Normy? How about we top you off? Perhaps we need to ask a bigger question - maybe the Federal Government is doing a whole lot more than it probably ought to be doing. One of those things? Writing checks.

And here's the best part - they're buying your votes with what used to be your money.

Both teams are acting like those screaming kids in the cereal isle.

What amazes me, is that normal people are getting upset.

"I can't believe they're politicizing this issue..."

THAT'S WHAT THEY DO. That's all this is! It's a political battle - highlighting the useless partisan blinders to obscure the actual truth. We Broke!

And it's broke, it's time to roll up the sleeves and fix it. It's not going to be easy, and given our current attitude of entitlements and leaders who are more interested in their own interests -- we're exactly what I said 2 years ago. We're Greece.

And one last parting shot -- the Congress reflects exactly who put them there. The people who are walking away from underwater mortgages, who floated home equity loans based on inflated price assumptions to purchase stuff on credit to fill into those houses. Sounds similar, like the US debt situation, doesn't it?

No comments:

Post a Comment